Peserta

N/A

Penilaian

N/A

Sesi

N/A

Durasi Belajar

0 menit

Level

...

Sertifikat

...

Mitra Pengajar

Pengajar

Deskripsi

Materi

Penilaian

Ulasan

Peserta

N/A

Penilaian

N/A

Sesi

N/A

Durasi Belajar

0 menit

Level

...

Sertifikat

...

Ulasan

Peserta

N/A

Penilaian

N/A

Sesi

2

Durasi Belajar

60 menit

Level

Intermediate

Sertifikat

Tidak Bersertifikat

N/A

Ulasan

Belum ada ulasan

Rp 65.000

Akses kursus hingga 12 bulan

Kursus Digital Transformation Book ini memberikan pemahaman yang mendalam dan praktis tentang digital transformation book untuk membantu Anda mengembangkan keterampilan yang diperlukan dalam bidang tersebut. Cocok untuk pemula maupun profesional yang ingin meningkatkan kemampuannya.

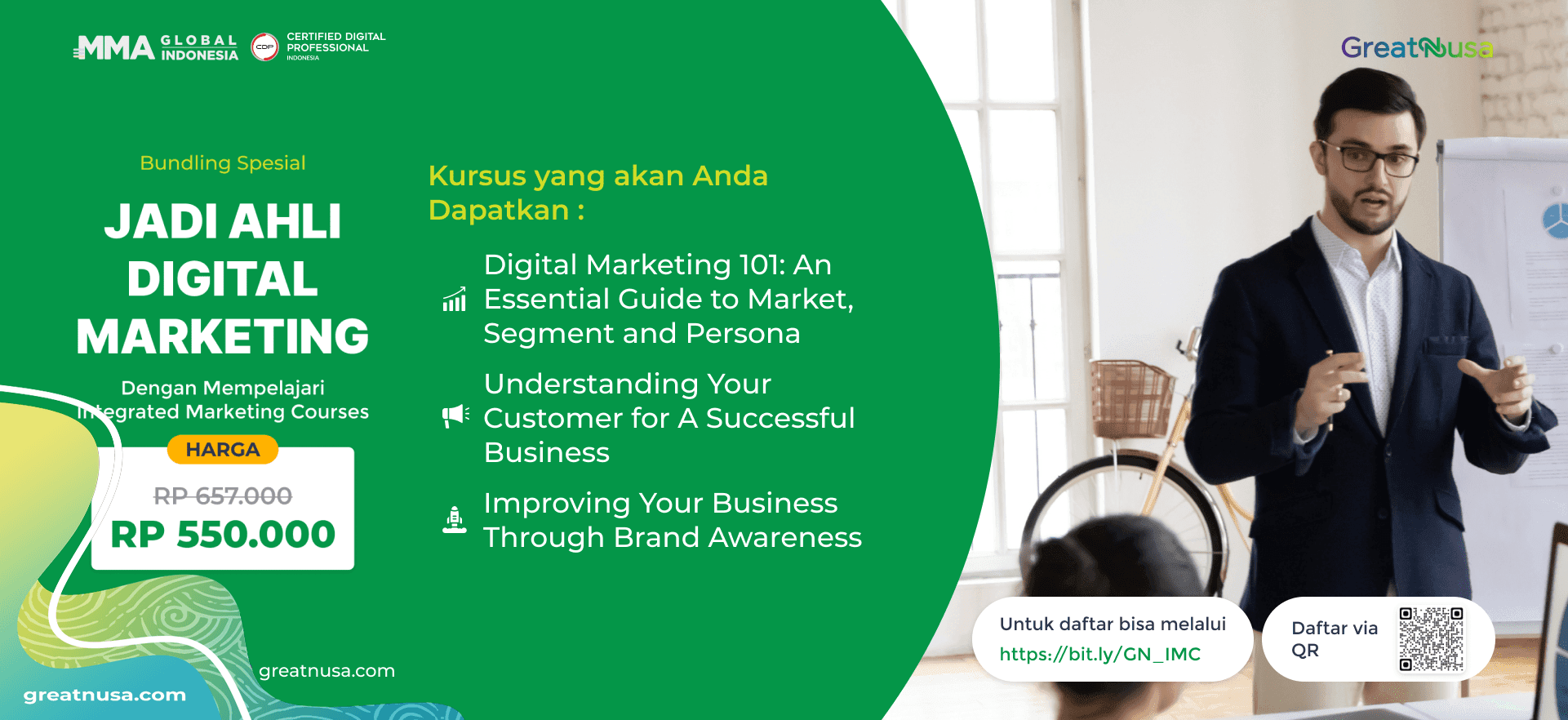

Gratis

Kursus Special Bundling Integrated Marketing Courses ini memberikan pemahaman yang mendalam dan praktis tentang special bundling integrated marketing courses untuk membantu Anda mengembangkan keterampilan yang diperlukan dalam bidang tersebut. Cocok untuk pemula maupun profesional yang ingin meningkatkan kemampuannya.

Rp 550.000

Kursus Jadi Pemimpin yang Efisien di GreatNusa ini memberikan pemahaman yang mendalam dan praktis tentang jadi pemimpin yang efisien di greatnusa untuk membantu Anda mengembangkan keterampilan yang diperlukan dalam bidang tersebut. Cocok untuk pemula maupun profesional yang ingin meningkatkan kemampuannya.

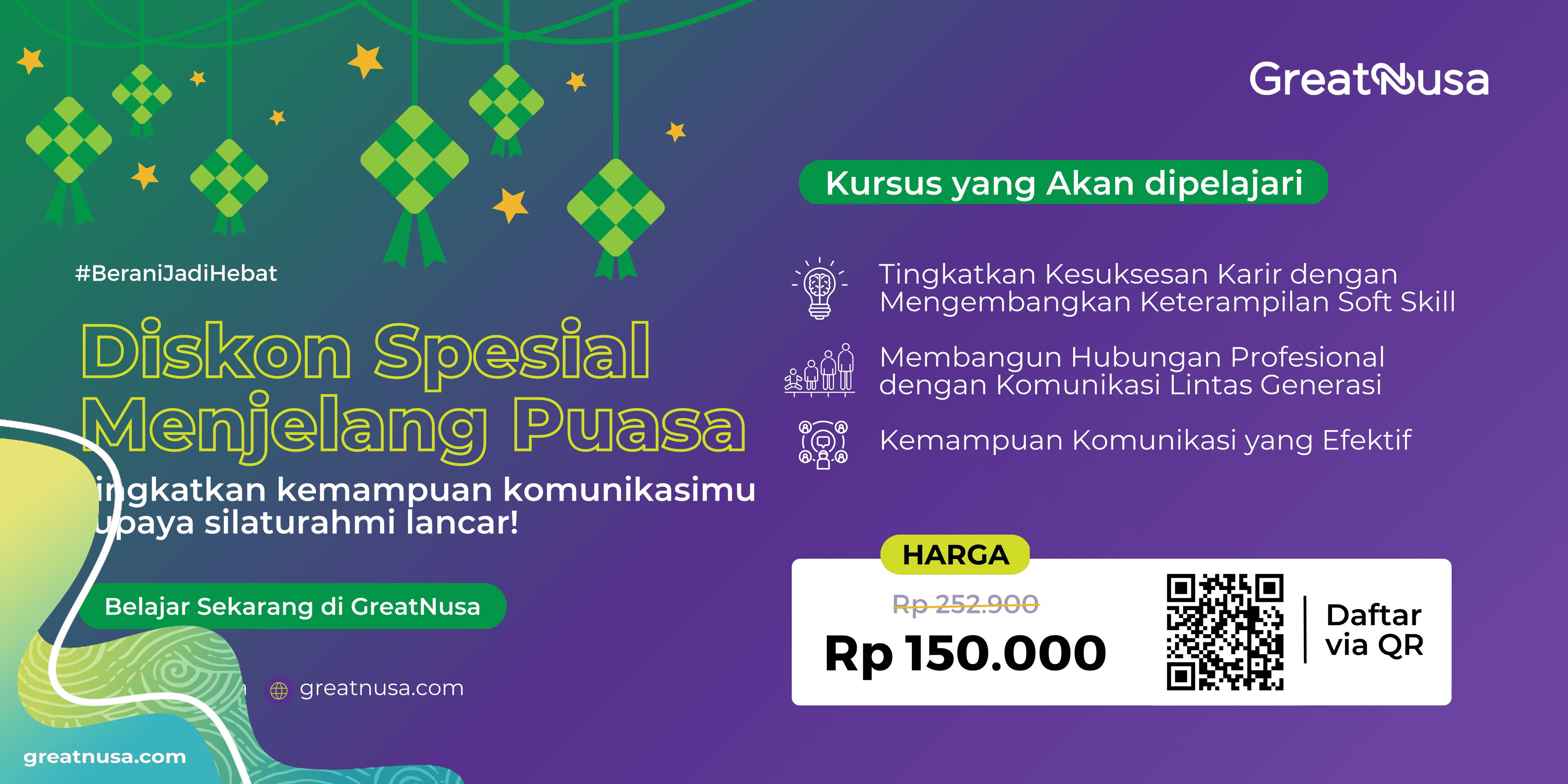

Rp 150.000

Kursus Jalin Silahturami dengan Komunikasi yang Hakiki ini memberikan pemahaman yang mendalam dan praktis tentang jalin silahturami dengan komunikasi yang hakiki untuk membantu Anda mengembangkan keterampilan yang diperlukan dalam bidang tersebut. Cocok untuk pemula maupun profesional yang ingin meningkatkan kemampuannya.

Rp 150.000

Kursus Microlearning Jadi Hebat di Keuangan ini memberikan pemahaman yang mendalam dan praktis tentang microlearning jadi hebat di keuangan untuk membantu Anda mengembangkan keterampilan yang diperlukan dalam bidang tersebut. Cocok untuk pemula maupun profesional yang ingin meningkatkan kemampuannya.

Gratis