267Peserta

Terakhir di update27/9/2024

LevelIntermediate

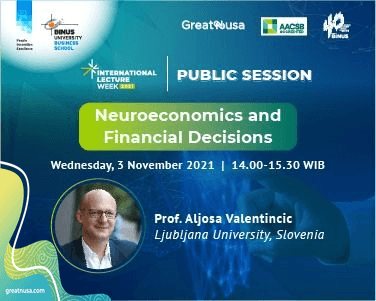

Neuroeconomics and Financial Decisions

Gratis

Akses kursus hingga 12 bulan

1 Sesi pembelajaran

Durasi belajar selama90 menit

Tentang Kursus Ini

Pelajari bagaimana prinsip neuroekonomi memengaruhi pengambilan keputusan finansial. Kuasai analisis perilaku konsumen dan investor untuk strategi bisnis yang lebih efektif dan keuntungan maksimal.

Traditional economics assumes that we, humans, are consistently rational, selfish agents, capable of complex calculations that maximize utility as consumers and profits as producers of goods and services. Yet, casual observation tells us that this may not always be the case. People trade shares on stock exchanges differently depending on the level of hormones in their body, financial analysts make different recommendations about shares depending on the weather, stock markets yield positive abnormal returns when home football teams win. People also often make mistake in reasoning, evaluating and remembering the state of the world around simply because they ignore contrary objective information available to them. They hold losing shares too long and sell winning shares too soon. They use heuristics, not complex calculations when making decisions, they frame their thinking depending on the context, ignore the easy-to-use discounting calculations in favour of hyperbolic discounting despite the fact that the resulting numbers often do not make sense even to a person not familiar with finance. Companies of course, humans in them) appoint CEOs in part based on their looks despite patchy evidence of their superior returns. All these examples inform us that we must look beyond mathematical formulas to describe the complex world around us, including in finance, accounting, financial statement analysis, and other branches of economics and business. Neuroeconomics helps us direct this search.

Materi yang Dipelajari

Recording

Recording - Neuroeconomics and Financial decisions

Attendance (Clock In/ Clock Out)

Webinar Link

Other activity

Evaluation

Evaluation

Certificate

Certificate

Mitra Pengajar

https://files.greatnusa.com/old-wp/2022/08/Binus-Creates-1.png

Pengajar

Penilaian

Mereka yang belajar kursus ini, juga mengikuti kursus di bawah ini.

Financial Statements for Startups

Pelajari cara membuat dan menginterpretasikan laporan keuangan startup. Kuasai 3 laporan utama dan analisis rasio keuangan untuk pengambilan keputusan bisnis yang strategis.

Amelia Limijaya, S.E., M.Acc.Fin., Valentina Tohang, SE., M.Bus(ERP)., M.Bus (Acc)

Rp 199.900